Warren Buffett's investment firm has amassed incredible wealth over the years. Nevertheless, the argument for purchasing shares at this moment is not as clear-cut.

Warren Buffett, the famed investor and one of the world's wealthiest individuals, built his fortune primarily through his holding company, Berkshire Hathaway (BRK.A -2.20%) (BRK.B -2.03%). Today, Berkshire Hathaway is worth nearly $1 trillion; its success is the culmination of a buy-and-hold strategy for numerous private businesses and stakes in public corporations.

Holding shares of Berkshire Hathaway is the nearest way to invest in tandem with Buffett.

Valuations play a crucial role in every investment decision. Warren Buffett, known for his emphasis on value, would likely argue that no stock is worth purchasing at any price. This principle is vital when determining whether to buy, sell, or retain shares of Berkshire Hathaway at this moment.

So, what’s the answer? Here’s the information you need to be aware of.

One thing is certain: Berkshire Hathaway delivers value to its shareholders.

The inner workings of Berkshire Hathaway or any other holding company can seem like murky waters. There are so many moving parts that your head might spin. But if you think about it, a holding company is a business that owns other businesses.

Berkshire Hathaway owns dozens of private businesses, including railroads, GEICO insurance, Dairy Queen, See's Candies, and more. They operate independently, and their profits go to Berkshire (parent company). If Berkshire Hathaway's stakes in public companies happen to pay dividends, they go to Berkshire's balance sheet in the same way. Some of Berkshire Hathaway's notable investments include stakes in Apple, Bank of America, American Express, and Coca-Cola.

In a sense, we investors function as our own personal holding companies.

At that point, Buffett and the other members of Berkshire Hathaway's management team determine the best strategies for utilizing the funds to enhance shareholder value. This might include acquiring or investing in other businesses, buying back Berkshire Hathaway shares, or exploring alternative options.

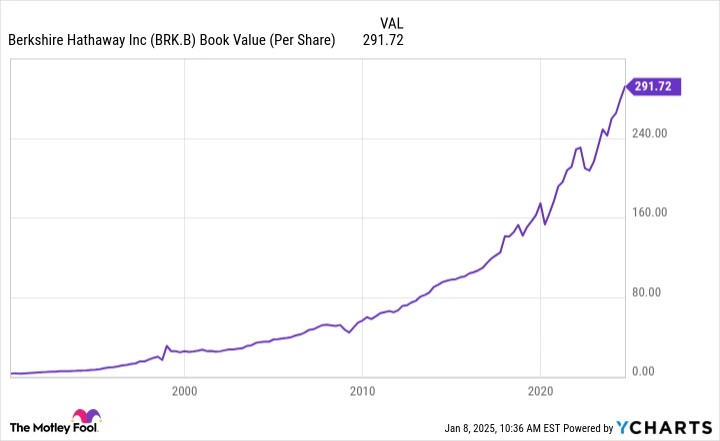

The Berkshire Hathaway team has created immense value for its shareholders. You can see this reflected in the company's book value over the years below:

View pictures in App save up to 80% data.

In conclusion, this graph illustrates the reasons behind the impressive performance of Buffett and other long-term shareholders of Berkshire Hathaway. While it doesn't assure future victories for the company, it provides investors with reassurance regarding its capacity to navigate economic fluctuations and adapt to an evolving landscape.

Currently, there are some concerns regarding Berkshire Hathaway's stock performance.

What's the problem, then? You might guess Buffett's age. Sure, he's in his 90s, something worth considering if you're thinking decades into the future. But that's been thought of already. Buffett's successor has spent years at the company and probably deserves the benefit of the doubt, especially given how financially equipped Berkshire Hathaway is. The company is currently sitting on roughly $325 billion in cash, a financial armory ready for the right opportunities.

My main concern can be summarized by what is arguably Warren Buffett's primary investment philosophy: value.

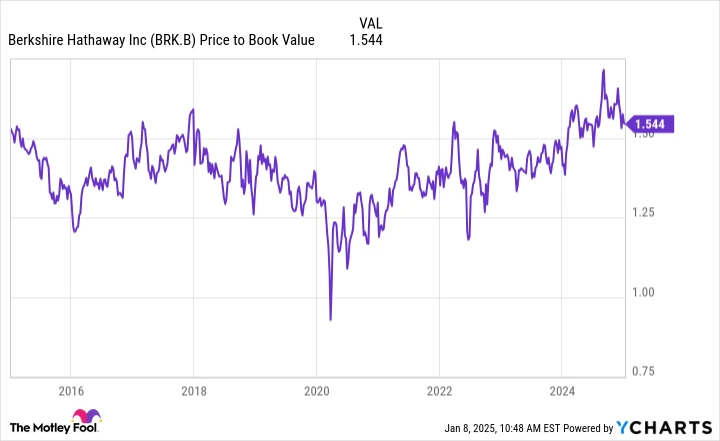

When assessed using book value, the same metric we utilize to evaluate Berkshire's growth, the stock is currently approaching its highest valuation in the past ten years.

View pictures in App save up to 80% data.

Not to lean too heavily on what someone else does (or doesn't do), but Berkshire Hathaway didn't repurchase any of its class A or B shares in the third quarter of 2024. Perhaps that will change when the company reports fourth-quarter results, but it doesn't look like Buffett and Co. see much value at these prices. On the other hand, Berkshire Hathaway has primarily sold stocks to increase its cash holdings over the past few quarters.

Should you purchase, divest, or maintain your position?

It may not come as a surprise, but labeling Berkshire Hathaway as a buy at this moment is challenging. Buffett's hesitance to buy back shares is significant, and the company's elevated valuation compared to historical averages raises concerns. Nevertheless, Berkshire Hathaway remains a standout performer and a solid choice for a buy-and-hold strategy within a diversified investment portfolio. Investors should be cautious about letting go of such valuable stocks and carefully consider their decision before selling if they are already shareholders.

Should Berkshire Hathaway's valuation return to its historical norms or if the company undertakes a significant acquisition using its cash reserves, the stock could quickly find itself back in favorable buying range. For the time being, it's best to remain patient and ride out the current situation.