Cathie Wood and Warren Buffett have contrasting investment strategies, yet both investors share a stake in a lesser-known emerging player within the fintech industry.

Two investors that could not be more opposite are Cathie Wood and Warren Buffett. Wood is the CEO and chief investment officer of Ark Invest, a firm that focuses on investments in emerging themes such as artificial intelligence (AI) or genomics. By contrast, Buffett has spent most of his tenure at Berkshire Hathaway owning blue chip stocks as opposed to higher-risk, volatile opportunities in growth sectors.

Yet despite their different philosophies, Wood and Buffett do have some overlap between their respective portfolios. One company that Ark and Berkshire both own is called Nu Holdings (NU -1.71%). Nu is a fintech player that specifically focuses on Latin and South America.

Let's explore the reasons why Nu appears especially appealing at this moment from a valuation standpoint and discuss why 2025 might be a pivotal year for this lesser-known commerce opportunity.

Nu's operational performance is exceptionally robust.

Nu is a digital financial services platform offering a comprehensive range of products, including checking and savings accounts, investment options, loans, and beyond. Throughout its history, Nu has primarily concentrated on markets like Brazil, Colombia, and Mexico.

However, back in December, the company announced that it was participating in an investment round for digital banking platform Tyme Group -- which boasts 15 million customers across South Africa and the Philippines.

At the end of the third quarter (ended Sept. 30), Nu had 110 million members on its platform, which signaled 23% growth year over year. Moreover, the company's average revenue per user (ARPU) rose incrementally to $11 per member.

By making its customers more profitable over time, Nu has been able to widen its margins and expand profitability. During the third quarter, Nu's gross margin increased by 300 basis points and net income rose by 83% year over year to $553 million.

View pictures in App save up to 80% data.

The company's growth makes its valuation particularly attractive.

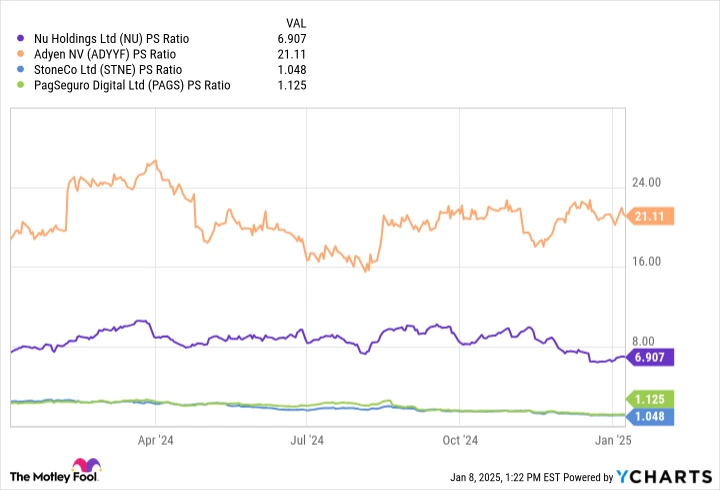

Per the chart below, Nu trades right in the middle among this peer set of other international fintech operations based on the price-to-sales (P/S) ratio.

View pictures in App save up to 80% data.

Although this may suggest that Nu is priced appealingly compared to its peers, what really catches my attention is the consistent downward trend in the company's P/S ratio. Over the past few months, Nu's P/S has been on a persistent decline. I believe a significant factor contributing to this is the broader economic climate in Latin America, especially in Brazil.

While I acknowledge the validity of these concerns, I don't view these factors as justification for divesting from the stock.

Nu makes me think of SoFi.

One stock that has had a rough go for the last couple of years is SoFi. SoFi is a very similar business to Nu in that it offers many of the same basic financial services, all through the convenience of a mobile app.

Although SoFi has a number of different products, the company's largest source of revenue by a mile stems from lending. Given the U.S. experienced abnormally high levels of inflation over the last few years, the Federal Reserve resorted to some aggressive shifts in monetary policy -- raising borrowing costs 11 times between 2022 and 2023. These moves significantly impacted SoFi's lending operation, and for a prolonged period of time investors fled the stock.

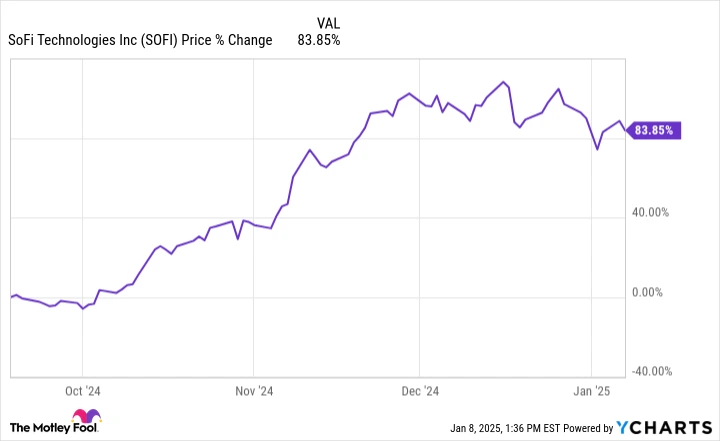

However, the economic picture steadily started to improve, and in the final months of last year the Fed started to aggressively taper interest rates. Unsurprisingly, SoFi began witnessing a swift bounce-back in its lending business, and enthusiasm around the stock started to rise. Since the first rate cut back in mid-September, shares of SoFi have risen by more than 80%.

View pictures in App save up to 80% data.

Worries regarding inflation and its impact on SoFi's operations reflect a similar apprehension surrounding Nu, especially considering the latter's susceptibility to Brazil's tough economic climate. However, it's important for investors to take a broader perspective and acknowledge that economic conditions tend to evolve and improve over time.

I believe the worries regarding Nu's short-term growth are justified. However, the long-term outlook remains exceptionally strong, highlighted by the increasing number of users, opportunities for cross-selling, growing profits, and overall economic growth.

I believe Nu is on a path akin to SoFi's and view the stock as a great opportunity for long-term investors.